Promoting More Equitable Access to the U.S. Safety Net for Children of Immigrants

The U.S. social safety net—or the collection of government programs established to meet basic needs and provide economic security—is too often set up to exclude children of immigrants. This brief discusses how safety net policies and practices respond to the U.S. job market and interact with the U.S. immigration system, and how this patchwork of systems creates barriers and limits access to such children. The brief then offers policy recommendations that can promote greater inclusivity for children in immigrant families.

Children of immigrants will make up a significant share of the United States’ future population and future workforce. One in four children (18 million) in the United States are children of immigrants, with the vast majority being U.S. citizens. The prosperity of our nation will very much depend on who these children will grow up to be, which—in turn—depends on how well they are supported in their childhood. Nevertheless, major U.S. policies and programs that provide support and benefits to children and families in many cases explicitly or implicitly exclude children of immigrants. Such exclusion can hurt U.S. children by increasing disparities in child health, educational attainment, and earnings and employment in adulthood.

This brief examines exclusionary U.S. safety net and other policies that limit safety net access for children of immigrants. First, the brief begins with an overview of how the United States and its safety net constitute a “welfare state”—a term specifically referring to the ways in which the public and private sectors are structured to provide economic security to members of its society—with a specific focus on the safety net’s treatment of immigrants. Second, the brief discusses program rules and administrative barriers across government social and tax programs that disproportionately and adversely affect access for children of immigrants. Third, the brief explains how immigration and immigrant-related policies interact with the safety net in limiting access to programs by children of immigrants. Fourth, the brief concludes by recommending four areas of policy change to promote economic equity for children in immigrant families. These include limiting administrative barriers to safety net access, countering the exclusionary effects of private markets, separating immigration enforcement from health and human service operations, and providing work authorization to elevate economic self-sufficiency for immigrant families.

U.S. Safety Net Overview and Access Among Immigrant Families

The U.S. safety net is a set of government programs that disburse economic resources to members of U.S. society to meet their basic needs and provide economic security. However, as this brief will show, the line between public and private provisions can be blurry in the policy context of the United States—a country that stands out among high-income countries for its strong emphasis on the private sector and its reverence for classic or laissez-faire liberalism (a belief in less government intervention). This structuring of the U.S. welfare state has shaped access to safety net programs among children of immigrants.

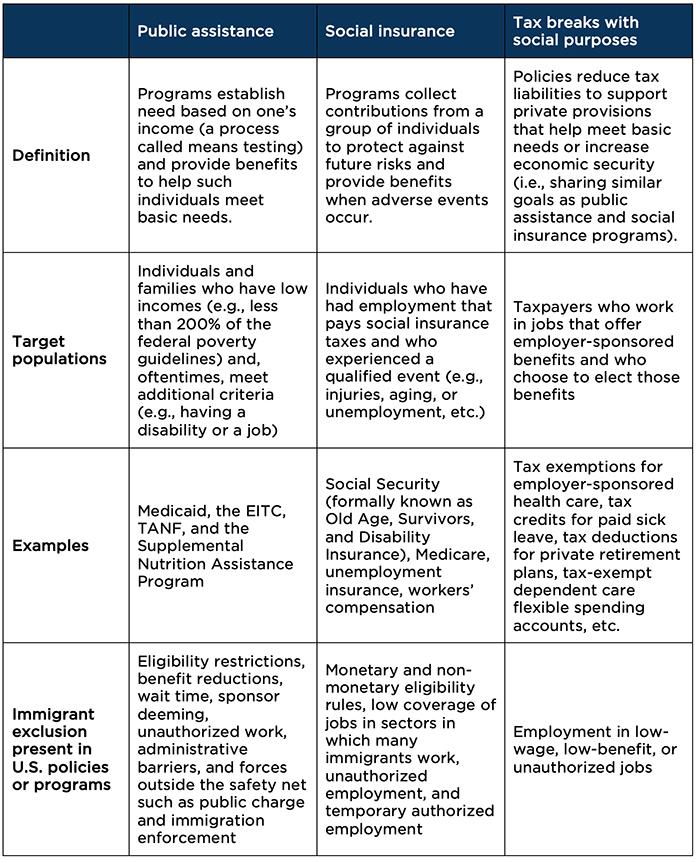

This brief considers three categories within the public safety net: public assistance programs, social insurance programs, and tax breaks with social purposes (also see the table at the end of this brief).

- Public assistance programs establish needs based on one’s income and provide benefits to help low-income individuals meet basic needs. Many U.S. public assistance programs serve specific subgroups of low-income populations such as children, those who are disabled, and the working poor. Programs provide benefits that range from relatively accessible in-kind benefits (e.g., Medicaid) to more restricted cash assistance (e.g., Temporary Assistance to Needy Families, or TANF). Some benefits are disbursed through the tax system but are considered public assistance in this brief because they target low-income families (e.g., the Earned Income Tax Credit, or EITC).

- Social insurance programs collect financial contributions from a group of individuals to share and protect against future risks; such programs provide benefits to members of this group when they experience qualified events, such as aging, sickness, and job losses. Examples include Social Security, Medicare, and unemployment insurance.

- Tax breaks with social purposes support private economic security arrangements through preferential tax treatments, such as tax exemptions, deductions, and credits. Examples include employer-sponsored health insurance, dependent care flexible spending accounts, and tax credits for paid sick and family leave. These tax provisions can be comparable to direct spending programs (e.g., child care subsidies) in that both provide access to economic resources and help meet basic needs; additionally, both categories incur governmental expenditures.[1]

In the United States, universal, unconditional safety net programs are largely nonexistent (e.g., universal health coverage), rare (e.g., universal basic income), or transient (e.g., the 2021 expanded Child Tax Credit). Therefore, this brief focuses on the three pillars of the safety net described above, with less emphasis on universal programs that provide unconditional benefits to all.

Children in immigrant families have varying degrees of access to this safety net that depend on their parents’ sector of employment, immigration status, years of residence, and years of formal employment in the United States. Since immigrant parents concentrate in jobs that offer low wages and low benefits, children of immigrants have relatively low access to employer- or job-based benefits and related tax breaks. Social insurance benefits are often connected to employment and can be out of reach for immigrant families depending on the circumstances of their jobs. Social Security and unemployment insurance coverage rates are low in jobs that employ many immigrants.[2] Immigration status disqualifies certain immigrant workers from receiving benefits but does not exempt their contribution to programs. For example, employers who hire unauthorized workers (knowingly or not) pay unemployment insurance taxes and may pass this cost on to workers, even though these workers are not eligible for benefits. Additionally, federal public assistance programs have never been available to unauthorized immigrants. Some programs have further curtailed eligibility for lawful immigrants, which in turn limits program access for their children. Conditioning public assistance on formal employment places benefits beyond reach for children whose immigrant parents perform informal work or who cannot work.

How immigration policy, jobs, and job benefits impact safety net access

Because the U.S. safety net places strong emphasis on the job market to promote family economic security, it is important to understand how immigration policy shapes employment prospects for immigrants with children. Immigration policy influences not only which immigrants arrive and live in the United States, but also how they fare in the U.S. job market, affecting both the private and public benefits to which they have access.

First, admission policies decide which immigrants can stay in the United States. Before the 1960s, policy explicitly favored European immigrants. The Immigration and Nationality Act of 1965, however, opened the door to immigrants from all parts of the world. The Latino and Asian share of U.S. immigrants has subsequently grown: The two ethnicities combined increased from 14 percent in the 1960s to 78 percent in the 2010s. Permanent resident admissions to the United States are predominantly based on family reunification and employment (66% and 14%, respectively, in the decade before the 2020 pandemic), as opposed to diversity and humanitarian purposes. Immigrants today are mostly in their prime age (ages 20–54), racially and ethnically diverse, and have high labor force participation rates. Immigration meets the U.S. labor market’s demand for high- and low-skilled workers, but also results in high income inequality among immigrants. Immigrants account for roughly 40 percent of the workforce with a bachelor’s degree or higher in STEM jobs, but they also are disproportionately represented in service and blue-collar occupations (construction, production, transportation jobs, etc.)—for example, over half of foreign-born working parents work jobs in such fields.

Second, immigration policy creates several immigration categories—permanent, temporary, precarious, and undocumented—with varying levels of privilege associated with each. These categories grant differential access to the labor market and employer-based benefits. Unauthorized workers earn less than their authorized peers with similar levels of education. Immigration enforcement and employer sanctions—intended to keep unauthorized workers out of the labor market—have been linked to reduced earnings and employment among unauthorized workers. For workers on temporary work visas, immigration policies that bind them to specific employers also render them vulnerable to wage and hour violations. Compared to their U.S.-born peers, foreign-born workers, overall, are at higher risk of unemployment and mass layoffs when recessions hit. They are also substantially less likely to have employer-sponsored health insurance and pension plans than their U.S.-born peers (by about 15 to 20 percentage points).

How the U.S. Safety Net and Its Connections to Employment Limit Access for Children of Immigrants

Access barriers imposed by public assistance programs

Despite immigrants’ job vulnerability, most public assistance benefits have excluded many lawful noncitizens since the 1990s, and undocumented immigrants have never been eligible for federal benefits throughout the United States’ history of social welfare programs. Two policies in particular—wait time and consideration of sponsor income—impede program participation among lawfully present immigrants and their children.

The Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA) made authorized immigrants ineligible for TANF, SNAP, and Medicaid during their first five years in qualified immigration status (e.g., permanent residents, asylees, and refugees), although many immigrants have lived in the United States for years before they retain this qualified status. PRWORA’s wait time requirements have the effect of restricting eligibility largely to U.S. citizens, as most permanent residents would qualify for citizenship after five years of permanent residence. Supplemental Security Income (SSI) limits eligibility to citizens or permanent residents who have earned 40 quarters of work.

PRWORA also changed the way family income is calculated for immigrants who have not become U.S. citizens. To obtain a visa, many immigrants are required to have a sponsor in the United States (e.g., an extended family member) sign an affidavit of support. Before PRWORA, these contracts were found by some courts to be more of a moral than a legal obligation; PRWORA made them legally enforceable until the sponsored immigrant becomes a naturalized U.S. citizen. This means that, to determine an immigrant’s eligibility and potential benefits, federal public assistance programs also count the resources of their sponsor (a process called “deeming”), lowering their chance of passing an income test.

Eligibility restrictions for most federal public assistance programs apply only to immigrant adults and not to their U.S. citizen children; however, as discussed below, this is not true of the Earned Income Tax Credit. Citizen children can usually be eligible for benefits on their own (e.g., Medicaid) or for prorated benefits based on the number of family members who qualify (e.g., SNAP). Prorated benefits lower incentives for immigrants to apply for benefits on their children’s behalf. Additionally, sponsor deeming can disqualify citizen children and other non-citizen family members altogether.

Access barriers imposed by the safety net and immigrants’ jobs

As discussed previously, the U.S. safety net places a strong emphasis on the job market to deliver economic security. This disproportionately limits access to economic benefits among children of immigrants through the following systems, given their ties to employment: public assistance, social insurance, and tax breaks for employer-sponsored benefits.

First, several public assistance programs that condition eligibility and benefits on authorized work and formal earnings can exclude from the safety net children whose parents are not authorized to work, cannot work, or have low earnings. For example, the federal Earned Income Tax Credit (EITC) disqualifies citizen children in immigrant families if any family member on their tax return (typically a parent) does not have a work-authorizing Social Security Number (SSN). However, undocumented immigrants are not exempt from tax liability, and many pay federal and state taxes with their Individual Taxpayer Identification Numbers (ITINs).

Second, the U.S. safety net provides preferential tax treatment to employers that offer economic benefits to employees, such as health insurance coverage and paid family and medical leave. Because immigrant workers are disproportionately employed in low-benefit or low-wage jobs, this approach can widen the inequality in economic security between children in immigrant and non-immigrant families. For example, employer-sponsored health insurance premiums are exempt from federal and payroll taxes. Since part of a worker’s compensation is not taxable, this reduces tax liability and increases disposable income to taxpayers. The savings are higher for workers with higher tax rates (typically those with higher incomes) and for workers who opt for more expensive employer-sponsored health insurance plans.[3] In 2022, tax expenditures on employer-sponsored health benefits totaled around $350 billion. However, immigrant workers often concentrate in occupations and industries that are less likely to offer health insurance benefits or paid sick leave, such as service, construction, and part-time jobs. Low benefits, combined with low earnings, create important gaps in access to publicly subsidized benefits among children of immigrants.

Third, while unemployment insurance (UI) prevented over 1 million children from falling into poverty when the COVID recession hit, this benefit is beyond the reach of many children in immigrant families due to eligibility criteria and the jobs in which immigrants work. Workers born outside the United States are less likely to receive UI than their peers who were born in the country. Several factors explain this gap. First, immigrant workers disproportionately represent the workforce of gig and contract jobs that are typically not covered by unemployment insurance. Second, for immigrant workers who are covered but who work in irregular and low-wage jobs, UI requirements of sufficient prior hours and wages may disqualify them. Unemployed immigrants who seek part-time jobs or are considered to have voluntarily left their employers are not qualified for UI in most states. Although federal incentives have been provided to states for adoption of policies that expand UI eligibility, reforms have been implemented unevenly across states. Finally, immigrants on work visas tied to single employers lose work authorization upon a job loss and, as a result, lose their eligibility for unemployment insurance.

To sum up, the U.S. safety net—which ties benefits and eligibility to authorized work, employment, and employer-sponsored benefits—may extend inequalities already present for immigrants in the labor market and widen disparities in economic security between children in immigrant and non-immigrant families.

Access barriers induced by red tape in government programs

Excessive, complex, rigid, or redundant policies and procedures in government programs can obstruct access for children in immigrant families, including eligible children. Some of these administrative barriers are immigrant-specific, while others simply disproportionately impact immigrant families.

First, immigration restrictions that differ across programs, states, and years can be overly complex to understand for both families and program staff. For example, authorized immigrants with low incomes may qualify for the EITC but may not be eligible for TANF because residency is defined differently for “tax purposes” and for “public benefits.” Immigrants who have been in qualified status for public benefits for less than five years may be eligible for the tax credit for marketplace health insurance premiums but not eligible for Medicaid due to the latter’s wait time requirement. Some states opt for federal options or use only state funds to additionally provide health insurance assistance to certain subgroups of immigrant families. Some of these provisions can change from year to year, depending on the state legislature’s budget negotiation. Frontline workers may find it difficult to recognize various immigration documents and stay informed about complex program rules.

Second, documentation policies and practices that assume all applicants are U.S. citizens can be particularly challenging to immigrant families. For example, asking for the parent’s SSN when only the child’s SSN is legally required or when neither SSN is required can limit program access. Instructions that do not clearly indicate whose SSN is required may lead immigrant parents to believe that they cannot apply on behalf of their children. Online application systems may not build in functionality for immigrants to apply for benefits (e.g., access requires standard IDs or SSNs), and call centers may be inadequately staffed to support cases with immigration-related barriers.

Third, government red tape that makes program participation burdensome for all families can be particularly taxing for immigrant families, especially those with limited education, social networks, access to technology, and language and cultural barriers—all of which inhibit opportunities to participate in programs. Eligibility recertification ensures that families still meet eligibility criteria after a period of benefit receipt. However, insufficient time to prepare for a recertification more negatively affects non‐English-speaking households than their English-speaking peers. Other factors—such as transportation barriers, undocumented employment, and nonstandard work hours—may result in challenges for immigrant families that are otherwise compliant with program application or recertification requirements. Requiring multiple proofs of residence can be difficult for immigrant families that do not have bank accounts or that share residence with other families.

Access Barriers Imposed by Immigration Policies That Constrain Immigrant Life

Immigration admission, enforcement, and laws constraining immigrant life—while not part of the safety net—can limit safety net access for immigrants and their children. These policies include the federal public charge rule (as part of immigration admission policy), state immigration control, and federal and state policies restricting immigrant rights.

First, a public charge determination based on prior use of public benefits can result in denial of admission to the United States or in immigrants’ inability to become lawful permanent residents. The current public charge rule applies only to persons with prior receipt of SSI, TANF, state/local cash assistance, and public long‐term institutional care, and admission denials due to public charge rarely occur. In 2020, a new public charge rule that extended the policy to include noncash assistance programs such as Medicaid and SNAP took effect but was rescinded soon after. During the debate leading to this rule and the period of uncertainty about its implementation, child uninsured rates increased and participation in food assistance programs declined among immigrant families, raising concerns about the rule’s deterrence effect. Confusion and fear about the proposed rule led families to forgo benefits for which they were eligible. Despite its rescission, research finds that immigrant families still see public charge as a barrier to programs even beyond those to which it specifically applies.

Second, heightened state and local immigration enforcement has been linked to reduced contact with social institutions among immigrant families, particularly for mixed-status families with citizen children. Policy changes in the 1990s permitted health and human service agencies to send information on undocumented immigration status to immigration enforcement (PROWRA Section 434). Policy changes also, for the first time, delegated certain federal immigration enforcement authority to state and local law enforcement (the Illegal Immigration Reform and Immigrant Responsibility Act of 1996 Section 287); immigration detentions and spending have since skyrocketed. The resulting impact on immigrant communities is broad, including declined Medicaid enrollment, health care utilization, school enrollment, domestic violence calls to police, and participation in businesses and public events, as well as increased material hardship among immigrant households. Identification verification, household information, and interviews required during a typical interaction with a government program can increase the risk of deportation, and immigration enforcement can remove breadwinners from children’s homes.

Third, state policies that restrict immigrants’ daily activities can limit access to the U.S. safety net for children of immigrants. For example, requiring hospitals to ask patients about immigration status can deter immigrant families from accessing health care. States barring drivers’ licenses to immigrants can limit mobility, economic opportunity, and access to the safety net for immigrants and their children.

Immigration admission and enforcement, and local policies that restrict immigrants’ activities, can limit immigrant families’ access to the safety net, public assistance programs, employer-sponsored benefits, and health care facilities and schools. These consequences, intentional or not, can be harmful to children of immigrants in the United States.

Recommendations for Equitable Inclusion of Children of Immigrants

Informed by the scholarship on welfare states, this brief considers the U.S. safety net to be an interwoven structure of public and private sector entities that provides economic security to members of society—including children of immigrants. Public assistance programs impose eligibility restrictions barring immigrant adults and interact with immigration and labor policies, limiting program access among immigrant families. Social insurance programs systematically exclude children of immigrants through their program requirements and through low coverage in jobs where immigrant workers tend to cluster. Tax expenditures on employer-sponsored benefits favor higher-income workers and workers who opt for more costly benefit plans, widening inequality in economic security for children based on the jobs their parents hold. In addition, administrative barriers and immigration policies deter immigrant families from accessing the U.S. safety net.

Policymakers should consider the following four reforms to equitably support the economic well-being of children from all familial or parental immigration backgrounds.

First, policymakers should broaden work authorization to include immigrant families in the U.S. safety net. Work authorization not only promotes economic self-sufficiency by allowing immigrants to work “on the books,” but can also grant access to public and tax benefits that are tied to jobs (the EITC, unemployment insurance, etc.). A few precedents show promising effects. For example, research finds that the Deferred Action for Childhood Arrivals (DACA) reduced the risk of poverty for households headed by DACA-eligible persons by 38 percent. The Immigration Reform and Control Act of 1986 also led to improved labor market outcomes for immigrants. As unauthorized immigrants are increasingly made up of long-term residents, it is time to reconsider broadening work authorization as a policy lever for promoting economic security for immigrant families.

Second, the U.S. safety net should counter the adverse, exclusionary effects that private markets—and especially the job market—have on the economic well-being of children of immigrants. Programs centered on child eligibility are best suited to this purpose, but even for these, policy reforms could expand benefits (e.g., the Child Tax Credit) or broaden access to all children (e.g., universal school meals). Tax expenditures on employer-based benefits should consider alternative designs that offer the same amount of benefits to workers across income levels—if not higher levels of benefits for lower-income workers. Unemployment insurance programs should expand coverage to low-wage workers and workers in gig and contract jobs. All these measures can potentially promote economic equity for children of immigrant workers concentrated in low-wage, low-benefit, and nontraditional jobs.

Third, public assistance programs should limit administrative barriers rooted in complex immigration restrictions by adopting a more consistent and streamlined set of policies. Safety net programs should also streamline eligibility determination and recertification processes, offer joint applications (or applications for multiple benefits), and improve program coordination and staff capacity to reduce the burden of program participation for families. Government programs should also eliminate administrative barriers that disproportionately impact access among immigrant families, such as the practice of asking for SSNs when they are not legally required for eligibility determination.

Fourth, to facilitate access, the U.S. safety net should separate immigrant enforcement from health and human services and strengthen cross-sector collaboration to remove barriers outside the safety net. Promising measures include eliminating the public charge, which has only been applied in a limited way but has created widespread fear and confusion for immigrant families. States could additionally offer driver’s licenses to immigrants to increase immigrant families’ mobility to participate in institutions such as the safety net, health care, and schools.

The U.S. safety net is tightly interwoven with the job market and the immigration system in shaping the economic security of children of immigrants. These structures together contribute to unequal access to the U.S. safety net among children by parental nativity, immigration status, time lived in the United States, and parents’ sector of employment. Complex rules within and across programs, government sectors, and geographies erect additional barriers for immigrant families to accessing the safety net. Policymakers should take a holistic approach by looking across systems and programs to strengthen the U.S. safety net for children of immigrants.

Major Categories of U.S. Safety Net Programs

Notes: (a) This table does not list unconditional universal programs since they play a lesser role in limiting safety net access among children in immigrant families—mostly because such programs are rare in the United States. (b) Some benefits disbursed through the tax system are considered public assistance in this brief because they target low-income families (e.g., the EITC).

Acknowledgements

The author thanks Dr. Dolores Acevedo-Garcia for her thoughtful review and Kristen Harper for her helpful feedback on earlier drafts of this report.

Footnotes

[1] Tax breaks for social purposes (or to incentivize a socially desirable level of consumption of goods or services such as dependent care and health insurance) forgo government revenue and thus are typically conceptualized as one type of governmental expenditures. Different from direct spending programs, tax expenditures do not enter a government’s budgetary process. Like direct spending, tax spending reduces the fiscal balance available to a government.

[2] For example, it has been estimated that the Social Security coverage rate is less than 75 percent among Mexican immigrants who are legal permanent residents (in the 2000s), compared to over 95 percent among all U.S. workers (in the late 1990s). In addition, several categories of jobs in which foreign-born workers are disproportionately represented, such as self-employed workers and agricultural workers on small farms, are mostly excluded from unemployment insurance coverage.

[3] Consider an employer with an effective marginal tax rate of 25 percent and employer-sponsored health insurance that costs $10,000 in annual premiums. If this benefit was offered as a wage compensation instead, it would be worth only $7,500 after tax for the employee. In this scenario, there is a tax expenditure (or forgone tax revenue) of $2,500. Alternatively, this benefit could be offered in a direct spending program—for example, in the form of subsidies or vouchers for families to purchase health insurance plans.

Suggested citation

Chen, Y. (2024). Promoting more equitable access to the U.S. Safety Net for children of immigrants. Child Trends. DOI: 10.56417/4238c3806a

© Copyright 2025 ChildTrendsPrivacy Statement

Newsletter SignupLinkedInYouTube