Lessons From a Historic Decline in Child Poverty

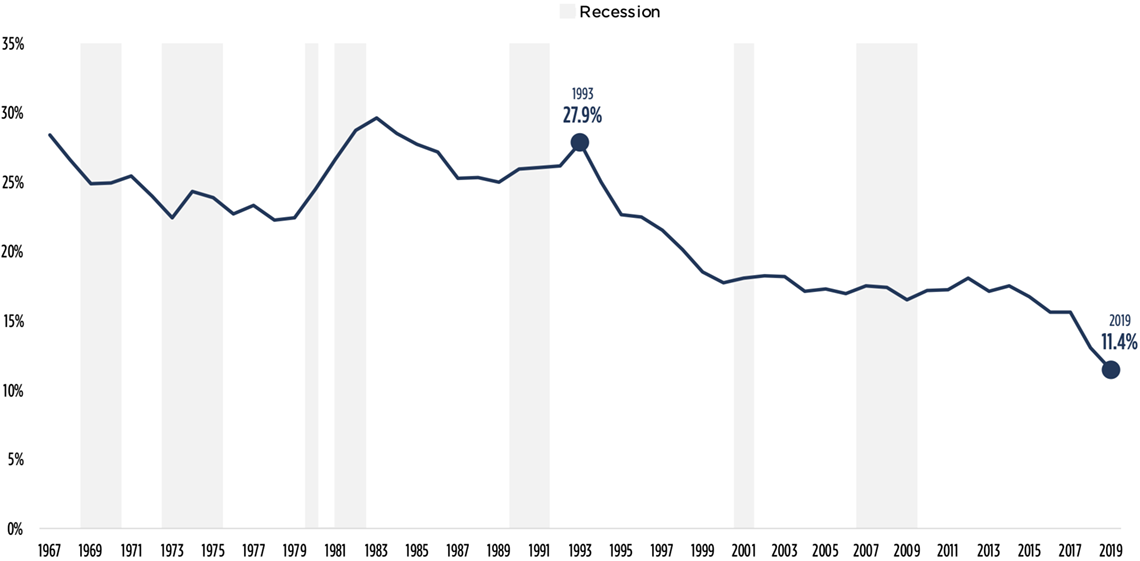

The past quarter century witnessed an unprecedented decline in child poverty rates. In 1993, the initial year of this decline, more than one in four children in the United States lived in families whose economic resources—including household income and government benefits—were below the federal government’s Supplemental Poverty Measure (SPM) threshold. Twenty-six years later, roughly one in 10 children lived in families whose economic resources were below the threshold. This is an astounding decline in the child poverty rate, which has seen child poverty reduced by more than half (59%; see figure below). The magnitude of this decline in child poverty is unequaled in the history of poverty measurement in the United States.

What led to this remarkable decline in child poverty? And did all subgroups of children experience similar declines? We set out to answer these questions, to understand the constellation of influences that led to this decline, with the hope that what we learned would help policymakers sustain—and accelerate—progress.

This executive summary encapsulates the report’s main findings and policy recommendations.

Child Poverty Rates Measured Using the Supplemental Poverty Measure (SPM), 1967-2019

Note: To provide context for the more recent decline in child poverty, we present trends in child SPM poverty rates back to 1967.

Sources: Child Trends’ analysis of the historical Supplemental Poverty Measure data from the Columbia Center on Poverty and Social Policy, anchored to 2012 thresholds. Recession data are from the National Bureau of Economic Research.

What does it mean to live below the poverty threshold?

Consider a single mom with two kids who lives in, let’s say, Columbus, Ohio. She works, on average, 30 hours a week, taking every shift available to her. Earning about $3 per hour above Ohio’s minimum wage in 2019, she would make $18,018 a year. Subtracting expenses (payroll taxes and transportation, medical, and child care costs that total an average of $4,830 per year) brings her disposable annual income to $13,188, roughly $10,000 below the 2019 SPM poverty threshold of $23,200 (for her family size and location). This amounts to about $1,100 a month to cover costs: rent, utilities, food, clothing, and other necessities. Consider, further, that this mother has access to several federal social safety net programs. The cash value of this assistance moves her income to the other side of the official poverty line, landing her just above the SPM poverty threshold of $23,200 and raising her monthly disposable income by about $1,000, to $2,100.

While that support makes a remarkable difference for this family, living and supporting two children on an annual income of about $25,000—or $2,100 per month—is hard. Quite hard. The Census Bureau defines the poverty threshold as the income below which families do not have sufficient resources to meet their basic needs. While the current poverty threshold is a critical frame of reference for conversations around poverty, we think—as do many poverty experts—that an income at or just above the current threshold does not allow most people to meet basic needs, much less save for the unexpected or make investments that could enhance their future economic security. While moving families across the current poverty threshold is an important goal, we want to emphasize that this does not always mean they have adequate resources to meet their basic needs.

Understanding the decline in poverty will help us continue the decline

Poverty is unequivocally linked with poorer child outcomes, particularly when poverty persists throughout childhood. This relationship is known but bears repeating. Lack of nutritious food, clothing, safe and stable housing, health care, and education—as well as the chronic stress that this lack of resources creates—can, in turn, have deleterious consequences for children’s health, academic achievement, social-emotional functioning, and long-term well-being and economic success. Reducing child poverty and promoting economic security and mobility not only improves well-being for children and their families, but also has long-term net benefits for society, such as higher taxes paid, lower health care costs, and less crime. The healthy development of our children—our nation’s future workers, leaders, taxpayers, parents, and neighbors—is critical for a thriving nation.

For these reasons, the United States must continue its collective efforts to further extend the past quarter century’s decline in child poverty rates. The lessons of this decline provide powerful insights into how we can continue to reduce child poverty. The past has much to say, and we should listen. Public policies can impact the lives of children and their families and can do so with great potency. Sometimes their impact is spot-on and intended. Sometimes their impact yields unexpected consequences. And, sometimes, their impact achieves intended yet counter-productive results. Policies also affect children in different situations with varying degrees of success. How policymakers choose those individuals who may participate in and benefit from our economy—who is helped in times of recession and economic hardship—matters greatly. And by better understanding what progress has been made—and what led to it—policymakers will be better able to sustain, and accelerate, further progress.

View Our Related Resources

Download: PDF (7 MB)

Explore: State-level Data for Understanding Child Poverty

Sign Up: Child poverty newsletter

Read: How Poverty is Measured in the United States

Read: Summary of the Main Government Programs Aimed at Reducing Child Poverty in the United States

Research questions

We began our work eager to understand the influences that led to child poverty’s decline over the last quarter century. Numerous economic, demographic, and public policy shifts have occurred over this time. On the economic front, we’ve seen real (inflation-adjusted) growth in gross domestic product (or GDP) per capita, median household income, and state minimum wages. Single mothers’ labor force participation grew, particularly in the mid-to-late 1990s. And unemployment was lower in 2019 than in 1993. On the demographic front, the share of adults with at least a high school degree and the share of kids living in two-parent families (including cohabiting parents) grew, albeit only slightly for the latter. The shares of children who are Asian/Hawaiian/Pacific Islander, Hispanic, or living in immigrant families grew. Teen birth rates declined dramatically. On the policy front, we’ve seen a large increase in overall federal spending on social safety net programs, particularly refundable tax credits aimed primarily at working families with children. At the same time, we’ve seen a move away from out-of-work cash assistance and the introduction of new immigrant exclusion policies.

So, what led to this historic decline in child poverty? Using fixed effects regression models and descriptive counterfactual analyses, we set out to answer the following questions:

1. What led to this historic decline in child poverty?

-

- What roles have economic, labor market, and demographic factors played in explaining the declining poverty rate among children?

- Has the social safety net improved over time at protecting children from poverty?

2. Did all groups of children experience a similar decline?

3. For which children has the social safety net worked and who has it left behind?

Key findings

The quarter century of declining child poverty from 1993 to 2019 is a fantastic success story, but it is a nuanced story with caveats. What led to the unprecedented decline in child poverty over the past roughly 25 years? In Chapters 1 through 5, we explain our analyses and findings in detail; here, though, we summarize our key findings:

Finding 1. Lower unemployment rates, increases in single mothers’ labor force participation, and increases in state minimum wages explained about 33 percent of the overall decline in child poverty from 1993 to 2019, but healthy economic conditions alone were not sufficient to protect children from poverty.

- While GDP and median wage growth may have benefitted families at higher income levels, they were not associated with reductions in the rates of child poverty. A tighter labor market—and, to a lesser degree, increases in single mothers’ labor force participation and state minimum wages—were associated with decreases in child poverty and deep poverty.

- Together, lower unemployment, increases in single mother labor force participation rates, and increases in state minimum wages explained about 33 percent of the decline in child poverty and 41 percent of the decline in deep poverty from 1993 to 2019.

Finding 2. As a whole, while demographic shifts did not contribute to the decline in child poverty, they were associated with about 43 percent of the decline in child deep poverty from 1993 to 2019.

- Some demographic factors were associated with declines in child poverty rates, while others operated in the opposite direction—counteracting the first group of factors. In this report, we refer to this latter set of factors as countervailing forces.

- Changes in the shares of Black and Hispanic children and children in immigrant families within the United States—that is, the shares of children whose families disproportionately face barriers to good jobs, experience workplace discrimination, receive unequal pay and fewer benefits, or have limited access to social safety net programs—were positively associated with changes in child poverty. In other words, because of the substantial economic barriers that these groups face, changes in their shares of the population move the child poverty rate in the same “direction”—either upwards or down, as it were. Increases in the shares of Hispanic children and children in immigrant families, for example, put upward pressure on child poverty rates; if the systemic barriers that these families face did not exist, child poverty would have likely decreased even more from 1993 to 2019, all else being equal.

- While the dramatic decline in teen birth rates from 1993 to 2019 was not associated with decreases in child poverty rates, it was associated with a decline in rates of deep poverty among children. The decline in teen births was associated with 52 percent of the total decline in child deep poverty across this time. However, the association between teen birth rates and child deep poverty is reciprocal—that is, teen birth rates are a symptom of child deep poverty as well as a potential contributor to it—so causality is difficult to determine.

- Increases in the share of children living in two-parent families were associated with decreases in child poverty and deep poverty; however, from 1993 to 2019, the share of children living in two-parent families increased only minimally and so did not contribute much to the decline in child poverty or deep poverty during this time.

The number of children protected from poverty by the social safety net tripled from 1993 to 2019.

Finding 3. The social safety net was responsible for much of the decline in child poverty from 1993 to 2019, cutting poverty by 9 percent in 1993 and by 44 percent in 2019—tripling the number of children protected from poverty over this time.

- In 1993, the social safety net (within which we include federal tax and transfer programs, such as the Earned Income Tax Credit, or EITC) cut poverty by 9 percent compared to what it would have been without the safety net. In great contrast, in 2019, the social safety net cut child poverty by 44 percent. Over that time, the number of children protected from poverty by the social safety net more than tripled, from 2.0 million children in 1993 to 6.5 million children in 2019.

- The two programs that experienced the greatest growth in the percentage of children protected from poverty were the EITC and housing subsidies.

- In 2019, the EITC, Social Security, and the Supplemental Nutrition Assistance Program (SNAP) contributed the most to protecting children from poverty.

Finding 4. While the social safety net’s role in reducing child poverty grew considerably over the last quarter century, the United States has made little progress in strengthening the social safety net for children with the least resources—specifically for those in deep poverty. The social safety net reduced deep poverty among children by about two thirds in both 1993 and 2019.

- The social safety net continued to play an important role in protecting children from deep poverty over the past 25 years. However, we saw only minimal growth in the social safety net’s role in reducing deep poverty. The social safety net reduced child deep poverty by 62 percent in 1993 and by 66 percent in 2019.

- From 1993 to 2019, the role of what has been, historically, the most important program at protecting children from deep poverty—Aid to Families with Dependent Children (AFDC) and then Temporary Assistance for Needy Families (TANF)—greatly diminished; other programs partially filled this gap during the Great Recession, but many of the measures enacted were temporary.

- The relative stability of the social safety net’s role in reducing deep poverty stands in stark contrast to the growth of its role in reducing poverty over this time.

- In 1993, a single program may have been enough to pull a child out of deep poverty; in 2019, however, a combination of benefits across multiple programs was often necessary to lift a child out of deep poverty.

Finding 5. From 1993 to 2019, poverty rates declined—and declined at similar rates—for nearly all subgroups of children. This means that disparities by parental nativity, race and ethnicity, and family structure persisted.

- From 1993 to 2019, poverty rates declined at similar rates for nearly every subgroup examined: for children in immigrant families and those in non-immigrant families; for Asian/Hawaiian/Pacific Islander children, Black children, Hispanic children, and White children; and for children living in two-parent families and children living with no or one parent.

- Because child poverty rates declined at similar rates across groups, disparities in child poverty rates—by parental nativity, race and ethnicity, and family structure—persisted during the historic decline in child poverty.

- There is one exception to these patterns: Poverty, and particularly deep poverty, declined considerably for children with stably employed parents, but much less so for children without stably employed parents. Challenges to finding and maintaining secure employment can include health issues or disability, mismatches between skills and available jobs, limited job networks or resources, lack of access to affordable child care or transportation, and the many forms of discrimination that certain job seekers face.

Finding 6. The role of the social safety net in reducing child poverty grew from 1993 to 2019 for nearly every subgroup. However, the social safety net played a smaller role in reducing poverty for some groups of children—specifically, for children in immigrant families, Asian/Hawaiian/Pacific Islander children, Hispanic children, and children without stably employed parents.

- The social safety net has consistently played a greater role in protecting children in non-immigrant families from poverty than for children in immigrant families—exacerbating disparities in child poverty by parental nativity.

- Relatedly, the social safety net exacerbated some racial/ethnic disparities in child poverty: The social safety net consistently played a greater role in protecting Black and White children from poverty, compared to Asian/Hawaiian/Pacific Islander and Hispanic children—the groups most likely to live in immigrant families.

- As the social safety net shifted its emphasis from out-of-work assistance to work-based assistance, it left behind children with the least resources—those living in deep poverty whose parents are not stably employed.

Policy recommendations

While it is clear that we have achieved substantial successes, our nation’s collective work to protect children from poverty is not over. Based on our findings, we offer the following recommendations to federal, state, and local officials to maintain our collective progress in reducing child poverty and to reduce persistent disparities in child poverty. The first two recommendations address the social safety net, while the latter three address the economic and social constraints that place certain demographic groups at higher risk of experiencing child poverty.

Recommendation 1. Recraft social safety net programs to prioritize child needs and determine eligibility based on child needs, rather than parent characteristics.

The social safety net protects millions of children from poverty and is thus a critical investment in the healthy development and future of all our nation’s children. Our analysis shows both the incredible successes of the social safety net in safeguarding children and the places where it has left gaps: Current policies exclude children from the full benefits of the social safety net by setting eligibility criteria based on their parents’ characteristics, such as work status and immigration status. In contrast, a social safety net designed to alleviate child poverty would be intentionally more inclusive by centering children’s needs, and by eliminating requirements based on other parent characteristics.

The 2021 Child Tax Credit (CTC) and Advance Child Tax Credit represent examples of programs based on children’s needs, in two ways. First, the very premise of the 2021 expansion of the CTC was based on research that shows the importance of economic stability for child well-being and the value of investing in the early childhood years (a period of intensive brain development). The Advance CTC provided families with children predictable monthly payments of up to $250 per child for children ages 6 to 17, and up to $300 per child under age 6. Second, its eligibility requirements were based on the child’s citizenship status, not that of the parent.

By contrast, the EITC requires a completed tax return and a Social Security number for everyone claimed on a family’s taxes. Our analysis found that the EITC is one of the most significant and effective anti-poverty programs we’ve got; however, children who are U.S. citizens and have parents with Individual Taxpayer Identification Numbers, rather than Social Security numbers, cannot benefit from the program. Recrafting eligibility to direct resources to children experiencing economic hardship—and removing eligibility requirements that limit benefits based on immigration status and other characteristics—would support continued reductions in child poverty and improvements in the health and well-being of our nation’s children.

Recommendation 2. Ease administrative barriers to the social safety net for eligible families to reduce child poverty and deep poverty, and to mitigate disparities between subgroups of children.

Our research shows that access to multiple programs and supports—not just one—is often needed to lift children out of deep poverty, in particular. However, program requirements across social safety net programs vary widely with respect to income thresholds, application and documentation requirements (e.g., proof of residence), recertification processes, and other eligibility requirements and details. The result is a complex web of administrative barriers that is both difficult and time-consuming for parents to navigate. Application, documentation, and recertification procedures should be simplified and streamlined to make it easier for every family who qualifies for a program to access its benefits. To facilitate cross-program access, state and federal agencies should broaden categorical eligibility (that is, when eligibility for one program is sufficient to determine eligibility for another), automated enrollment processes, and outreach campaigns. When families in deep poverty qualify for four programs, we should not require them to fill out four applications, negotiate with four different agencies, and maintain certification of eligibility in each program in order to continue receiving needed benefits.

The United States has learned how to reduce administrative barriers during the COVID-19 pandemic—lessons that could be applied to programs operating in broader contexts, beyond emergency situations. For example, Pandemic Electronic Benefit Transfers (P-EBT) provided children already eligible for free or reduced-price lunches with benefits under SNAP. While states had to develop new policies and infrastructure to make the program work, P-EBT was largely successful in reducing food insecurity and supporting children in immigrant families. Implementation of the expanded CTC taught us about innovative alternative reach and delivery systems, including online portals for families that do not file taxes, alternatives to direct deposit for families that do not use banks, and outreach campaigns. By the most conservative estimates, more than one in five eligible families don’t receive the EITC. Continued reforms, such as automatic enrollment, would go a long way toward ensuring that tax and transfer programs reach all families they were intended to reach.

Recommendation 3. Support stable parental employment and more robust female labor force participation with fair labor markets, higher minimum wages, and affordable, accessible child care.

The benefits of a strong U.S. economy do not currently fully extend to children in families living in poverty. Our findings highlight persistently high rates of poverty among subgroups that face systemic barriers to accessing and maintaining stable employment. We recommend removing common barriers that prevent low-income families from accessing and maintaining employment that is both dependable and that allows families to support themselves. These barriers include lack of access to affordable and high-quality child care and transportation, neighborhoods with limited resources and opportunities, discrimination, inadequate pay, a lack of workplace accommodations for disabled parents, a lack of paid sick and family leave, discrimination against formerly incarcerated parents, and difficulties obtaining work authorization for immigrant parents.

Removing barriers to stable employment and increasing low wages may be critical strategies to reduce the persistent gaps in child poverty by race and ethnicity. Hispanic men, for example, have greater rates of labor force participation than men from other racial and ethnic groups, but Hispanic fathers often have low incomes, making it difficult for them to lift their children and families out of poverty. Meanwhile, research indicates that providing access to high-quality child care, addressing workplace discrimination, and reducing wage inequality are effective strategies for enabling female workers to easily participate in the workforce.

In addition to removing barriers to employment, it will be critical to ensure that work is sufficient to lift families out of poverty. Our analyses show that increases in state minimum wages were associated with reductions in child poverty. Higher minimum wages could further support families’ ability to maintain stable employment and support their children. In addition, reducing the phase-in period for the EITC could maximize the benefit for working families with the lowest incomes, whose wages alone are currently too low to support their families.

Tight labor markets were associated with decreases in child poverty and deep poverty.

Recommendation 4. Maintain low teen birth rates by increasing public investment in evidence-based teen pregnancy prevention strategies and safeguarding adolescents’ access to safe abortion.

The dramatic reduction in teen births from 1993 to 2019 was associated with the decline in child deep poverty over this time. Researchers have attributed declines in the teen birth rate to less teen sex and more contraceptive use; these factors, in turn, may have been due to media and messaging campaigns, availability of effective contraceptive methods, and pregnancy prevention programs. As of mid-2022, teen birth rates remain at historic lows, meaning that further reductions in teen births may be less dramatic and result in less pronounced reductions in child deep poverty.

In 2022, a momentous Supreme Court ruling—Dobbs v. Jackson Women’s Health Organization—overturned the legal precedent established by the 1973 Roe v. Wade court case, granting states broad flexibility to impose restrictions on abortion. Restricting adolescents’ access to abortion may slow or reverse recent teen birth trends, and, by extension, have a detrimental influence on child deep poverty. In recent years, teen pregnancy rates, adolescent abortion rates, and the proportion of all abortions completed by adolescents have declined. Still, as of 2019, adolescents ages 15 to 19 accounted for 9 percent of all abortions nationally (an estimated 53,049 abortions). And our analysis found that declines in teen births were associated with 52 percent of the decline in deep poverty rates for children from 1993 to 2019.

To prevent teen birth rates from rising, policymakers should work to ensure that adolescents have safe access to abortion, contraception, and evidence-based teen pregnancy prevention programs. This would likely safeguard recent reductions in child deep poverty.

Recommendation 5. Promote the economic, social, and caregiving benefits that families bring to children and their parents, and reform policies that undermine their role in children’s lives.

Drawing on our finding that the proportion of children in two-parent families is strongly associated with child poverty, we recommend that public officials promote and safeguard the benefits that families—including parents, partners, and extended family—can provide to children, and particularly those assets that the presence of a second parent or caregiver typically bring. Such benefits include economic resources and logistical, emotional, and caregiving support, among others. Other policies that support families—such as paid family leave and flexible work scheduling—can provide adults with greater opportunities and resources to support the children and parents in their lives.

Furthermore, public officials should carefully reform policies and institutions that undermine the consistent presence of stable caregivers in the lives of children, and especially those that undermine the role and presence of fathers. In 2020, nearly 7 percent of children and youth had a parent serve time in jail. Child welfare agencies also have a powerful influence over family stability and the presence of parents in children’s lives: Previous research has found that economic insecurity can increase a family’s chance of coming into contact with the child welfare system, and nearly all states’ definitions of neglect include a factor linked to low incomes such as inadequate food, clothing, or shelter. This connection between poverty and neglect can lead to the surveillance of families with fewer resources and the separation of children from their families.

While increases in the share of children living in two-parent families were strongly associated with child poverty, we recommend caution to readers in interpreting this finding. We specifically recommend caution in developing policy interventions that directly encourage parents to maintain or create two-parent households. Incentives to marry or otherwise maintain two-parent households could have the effect of directing resources away from children in single- or no-parent households; according to our analysis, these households need resources the most. Such incentives could also trap families who are experiencing domestic violence. A narrow focus on two-parent households may also miss opportunities. Research illustrates the role of extended family—for example, Black grandparents living with their grandchildren—in supporting children and parents.

Acknowledgements

We are grateful to our reviewers Regina Baker, Yiyu Chen, Dolores Acevedo Garcia, Hilary Hoynes, Kris Moore, and Marianne Page. They were generous with their time, their expertise, and their expansive knowledge of the poverty field and methodological approaches. We also appreciate their spirited encouragement. We thank six colleagues, in particular, for advising us on many, many, (yes, one more) many complex technical questions—Sam Field, Liana Fox, Heather Hahn, Julia Isaacs, Gabriel Piña, Laura Wheaton, and Chris Wimer. You are all rock stars in our eyes.

Our work greatly benefited from the research support from many smart, dedicated individuals at Child Trends. Thanks to Sydney Briggs, Madeline Carter, Yuko Ekyalongo, Heather Sauyaq Jean Gordon, Michael Martinez, Melissa Perez, Astha Patel, Zakia Redd, Emilia Sotolongo, and Lizy Wildsmith. We could not have done this without you.

The Child Trends Communications team was with us from the start, and we’re grateful for all they’ve done—designing figures, creating web layouts and data viz interactives, editing text, drafting tweets, and keeping us grounded in the space-time continuum. We thank Emily Baqir, Kelley Bennett, Brent Franklin, Alec Friedhoff, Olga Morales, Catherine Nichols, Stephen Russ, Lee Woods, and our web partners at Eleven11.

We thank Carol Emig for her commitment to building a body of child poverty work at Child Trends, and for her support and encouragement of this undertaking from beginning to end, giving us the time to both think and learn.

This report greatly benefitted from Jason DeParle’s insightful and pointed (yet always kind) questions about our work.

We thank the Edna McConnell Clark Foundation and MacKenzie Scott. Their unrestricted grants to Child Trends supported this in-depth study of child poverty.

Click to continue to Chapter 1: Introduction

View Chapter 1Suggested Citation

Thomson, D., Ryberg, R., Harper, K., Fuller, J., Paschall, K., Franklin, J., & Guzman, L. (2022). Lessons From a Historic Decline in Child Poverty. Child Trends. https://doi.org/10.56417/

1555c6123k

© Copyright 2025 ChildTrendsPrivacy Statement

Newsletter SignupLinkedInYouTubeBlueskyInstagram