Many households that have been disproportionately affected by the COVID-19 pandemic were also less likely to receive the first Economic Impact Payments (stimulus payments) in 2020—including Latino and Asian households and households with very low incomes—relative to other major racial and ethnic groups and their higher-income counterparts.

However, Latino and Asian households were no less likely than their peers to receive the second and third stimulus payments in 2021, after eligibility for stimulus payments was extended to members of mixed-immigration-status households (specifically, households in which some members had qualifying Social Security numbers while others did not) and following improved IRS outreach.

The economic impacts of the COVID-19 pandemic have been massive, with large-scale business and school closures, unprecedented levels of unemployment, and the ensuing recession—all of which have taken a disproportionate toll on Black and Latino households, immigrants, low-wage workers, and women with caretaking responsibilities. These broad impacts compelled the federal government to use the tax system to disburse three rounds of Economic Impact Payments (EIPs, also known as stimulus payments) to moderate- to low-income individuals and families in April 2020, January 2021, and March 2021. EIPs have played an important role during COVID, as the latest U.S. Census Bureau analysis finds that the initial stimulus payments are associated with a 4.5 percentage-point reduction in the poverty rate among children in 2020—the largest reduction among all major government benefit disbursals.

For most individuals, the tax system is an efficient mechanism for delivering emergency aid, requiring no applications and automatically depositing money to recipients’ bank accounts. However, tax-based income supports can systematically miss certain populations, such as individuals with very low incomes (likely without tax filing obligations), those with limited tax knowledge or access to tax preparation, and citizen children living with noncitizen parents. As tax systems have become a key mechanism for providing economic support to individuals and their children (e.g., the recent expansions of the federal Child Tax Credit and other state tax credits), it is important to understand which populations are less likely to be reached by the tax system to ensure a more equitable, inclusive approach.

In this brief, we present findings on the demographic and socioeconomic characteristics associated with the likelihood of stimulus payment receipt among households with children and moderate to low incomes (that is, roughly at or below EIPs’ income eligibility thresholds—$150,000 for married couples filing jointly and $112,500 for individuals filing as head of household; these households may be referred to as “lower-income” households throughout the brief). We find that Latino and Asian households were less likely to receive EIPs than Black and White households in the period following the first round of payments in 2020, but that, in 2021—immediately after the second round and during the period between the second and the third rounds of payments—their likelihoods of receipt were similar to (and sometimes higher than) those of Black and White households.

We note that an eligibility criterion broadened to include members with qualifying Social Security Numbers (SSNs) in mixed-status families and expansive government outreach may be the underlying forces bridging the gaps in receipt in 2021 (more information in the Policy Context section). Because Latino children living in poverty (4.3 million in 2019) make up the largest ethnic group among all U.S. children in poverty (12 million), we present accompanying analyses for Latino households with children. We conclude with a discussion on policy implications based on our findings, with a focus on how income supports may be designed to reach all intended recipients.

Policy Context

In March 2020, as the COVID-19 pandemic began to hit the United States, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law to provide the first round of stimulus payments. Taxpayers with adjusted gross incomes (AGI) on their 2019 or 2018 returns of up to $150,000 for married couples filing jointly and $112,500 for individuals filing as head of household were eligible for a payment of $2,400 and $1,200, respectively, with an additional $500 for each dependent under age 16. Payments were reduced by 5 percent of the amount by which a taxpayer’s AGI exceeded the threshold. Each family member appearing on the tax return was required to have a work-authorizing SSN for the family to qualify. The Internal Revenue Service (IRS) began sending these payments to eligible taxpayers via direct deposit in April 2020. Otherwise, the IRS sent checks or prepaid debit cards to people with addresses on file in late May to early June. In September, the IRS sent letters to almost 9 million individuals who normally did not file tax returns, but who might be eligible, with instructions on how to claim the payment, including guidance to use an IRS online tool to process the payment.

In December 2020, as the United States struggled with another peak of COVID-19 cases and hospitalizations, the COVID-related Tax Relief Act authorized the second round of stimulus payments: up to $600 for individuals ($1,200 for couples filing jointly) and $600 per dependent child, to those with incomes under the same thresholds established in the CARES Act. The law also extended payments to individual members of mixed-status families with valid SSNs and allowed them to retroactively apply for the first round of payments. With experience garnered from the first round of payments, the IRS was able to quickly disburse the second stimulus payments in batches in early January 2021. Those who did not automatically receive either the first or second stimulus payment could claim it retroactively on their 2020 tax return.

In mid-March 2021, authorized by the American Rescue Plan, the IRS sent a third round of payments: $1,400 for each eligible tax filer and each qualifying dependent. Income thresholds for the full payments were once again the same, and, as with the second stimulus payment, eligible families received the payment for each member with a valid SSN.

Analytic Approach

We analyzed nationally representative data from the Census Bureau’s Household Pulse Survey fielded during two periods of the pandemic: June–July 2020 and January–March 2021 (data on EIP receipt were not available in the interim of these two time periods). Data from the early period capture receipt of the first EIPs; data from the late period show receipt of the second and third EIPs. Due to a change in the wording of the survey question, data during the early period reflect cumulative and expected receipt, while data during the late period capture receipt in the past seven days (see Methodology section below). While this complicates comparison of rates of receipt between the early and late periods, we focus here on racial and ethnic gaps in receipt between the two time periods.

We first describe rates of EIP receipt and household characteristics of our samples: lower-income (defined by EIPs’ income eligibility thresholds) households with children (“households with children” hereafter) and lower-income Hispanic households with children (interchangeably referred to as “Hispanic households” or “Latino households”). We do not examine Asian households separately (one group that had lower receipt rates in the early period) due to small sample sizes in some covariates examined here. Then, we examine the time trend in the rates of receipt among all households, and by race and ethnicity, across the two periods. Finally, we summarize the results of multivariate analysis that examines how characteristics are related to the likelihood of EIP receipt and how these relationships have changed over the two periods of the pandemic, given changing eligibility criteria, outreach, and measurement over time (see Methodology). We report only statistically significant findings below.

Key Findings

Descriptive Analysis

Across both study periods (June–July 2020 and January–March 2021), slightly over three quarters of lower-income households with children and lower-income Hispanic households with children reported receipt of a stimulus payment (see Appendix A). Although there was little difference (one percentage point) in the rate of EIP receipt between Latino and other households across the two periods, we found sizeable differences when disaggregating data by period.

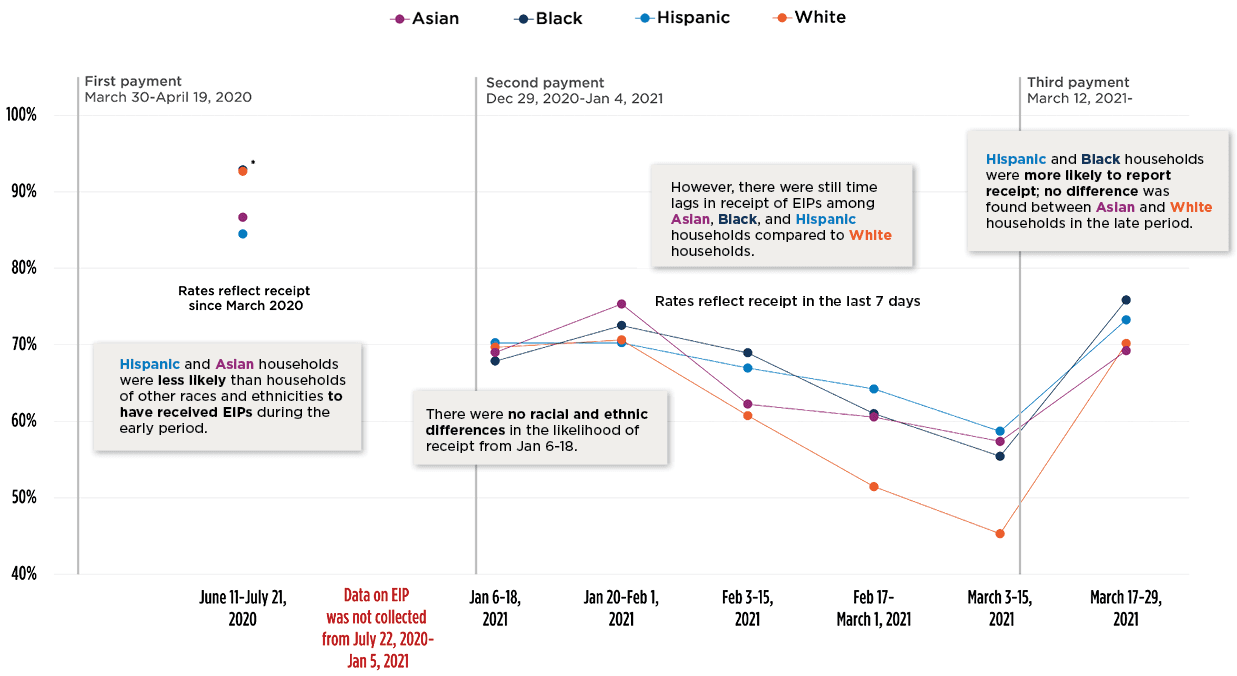

Hispanic and Asian households were less likely than households of all other races and ethnicities to have received EIPs in the early period (June–July 2020), but these gaps in EIP receipt shrank in the late period (January–March 2021) (Figure 1). The early period of our data followed disbursement of the first stimulus payment, while the second and third stimulus payments were disbursed at the beginning and end of the late period, respectively.

Rates of EIP receipt were more similar across racial and ethnic groups at the beginning and the end of the late period (January–March 2021) than at any point during the early period (June–July 2020) (Figure 1). For January 2021, the start of the late period (right after initial disbursement of the second round of payments), we found no racial and ethnic differences in the likelihood of past-seven-day receipt. At this time, most households were likely to receive EIPs through automatic disbursement. Between January and mid-March 2021, the federal government was mostly sending checks or debit cards via mail to those without direct deposit information on file and/or responding to new claims submitted through tax returns. At this time, Hispanic, Black, and Asian households were more likely to report EIP receipt in the past seven days than White households. Receipt rates subsequently declined for all groups, as should be expected, because households that could receive EIPs at each time point excluded those that had received them at the prior time point. However, receipt rates among Hispanic, Black, and Asian households declined less rapidly than those for White households, suggesting slower uptake among these groups. In the second half of March 2021, immediately after the announcement of the third round of EIPs, Hispanic and Black households were also more likely to report EIP receipt in the previous seven days than White households. We found no statistical difference between Asian and White households in the second half of March.

Rates of Economic Impact (Stimulus) Payment, with Receipt During Three Payment Periods by Race and Ethnicity and Among Moderate- to Low-Income Households

Click to View Figure Notes and Source

This simple time trend may be confounded with differences in the characteristics of households across periods. For example, the racial/ethnic differences in EIP receipt may reflect differences in incomes that are correlated with receipt (see Appendix A for more information about the characteristics of each sample). Because we were concerned that this time trend analysis may not solely describe receipt, we conducted multivariate analysis, adjusting for important correlates of receipt (Appendix B). In addition, we examined how the relationship between each household characteristic and receipt differed across periods—for example, whether the difference in receipt between households with lower and higher levels of education was larger or smaller in the late period than in the early period.

Multivariate Analysis

After adjusting for multiple factors, our analysis still found that EIP receipt rates among Hispanic and Asian households increased by roughly 10 percentage points, relative to White households, from the early to the late period (January–March 2021). Black households were also more likely than White households to receive EIPs in the late period (column B of Appendix B). Our multivariate analysis confirmed that the differences in EIP receipt among racial/ethnic groups across periods did not result from differences in observed characteristics of these groups across periods. This analysis allowed us to further explore the relationships between EIP receipt and other socioeconomic and demographic correlates.

Among all households and among Hispanic households, those with very low incomes (below $25,000) were less likely to receive a stimulus payment than households with mid-range incomes ($25,000–$149,000) in both periods. This difference was larger for Hispanic households than for all other households, indicating an even lower rate of receipt among Hispanic households with very low incomes.

Among Hispanic households, those headed by someone with a high school degree or below were less likely to receive EIPs in the early period (June–July 2020) than their higher-educated counterparts. However, this difference was substantially reduced and even reversed in the late (January–March 2021) period. Similarly, the receipt rate was also higher, overall, among households that were headed by someone with a high school degree or below than among those headed by someone with higher educational levels in the late period; this stands in contrast with the similar likelihoods of receipt between these groups in the early period.

Among all households and among Latino households, households with self-employed respondents had lower EIP receipts in the early period (June–July 2020) than those with respondents who were not self-employed. However, the share of households with self-employment in both samples was small (6%). The differential likelihood of receipt diminished for these households in the late period.

Discussion

Evidence shows that the COVID-19 recession, with its record spike in unemployment rates, has led to wide-ranging economic hardships across the country. Black and Latino individuals, female-headed households, immigrant workers, and Asian communities were hit particularly hard. This has placed many of these households at higher risk of experiencing poverty, housing insecurity, and multiple hardships—each of which carries significant implications for the health and well-being of individuals and children residing in households. In April 2020, early January 2021, and late March 2021, three rounds of EIPs were quickly disbursed from the federal tax system to many tax-filing low- to moderate-income households. Our analysis of households with children shows that some groups were substantially less likely to receive the first round of payments—particularly Latino and Asian households, households with very low incomes, and households headed by self-employed adults. However, some of these gaps were bridged in subsequent rounds of stimulus payments, following the extension of payments to members of mixed-status households with qualifying SSNs and improved outreach campaigns.

Our results suggest that a particular series of remedial factors may be promising: the tax system’s responsiveness to known limitations of its reach and subsequent adjustment via outreach; the use of alternative means of accessing payments for non-filers; and the revision of an exclusionary eligibility rule. Although our analysis cannot establish causal relationships between policies and receipt, prior studies suggest potential relationships. For example, prior research finds that expansive outreach and user-friendly means of accessing payments increased participation in the Earned Income Tax Credit (EITC) among individuals with low incomes. Other administrative barriers, such as complex tax rules, and contextual factors—such as a lack of internet access or financial services, and limited English proficiency—can similarly impede access to tax-based benefits. Moreover, our finding about increased receipt following the revision of an immigrant-exclusionary eligibility rule (excluding persons who had qualifying SSNs in a family with some members who did not) adds to our knowledge about how government programs may inadvertently exclude target populations who are part of broader immigrant communities. These factors constitute the background for understanding our findings about lower receipt among Latino and Asian households, and among households with very low incomes and levels of education. These findings are generally consistent with prior evidence about differential receipt of another tax-based income transfer, the EITC, suggesting that these gaps have historically been systematically present in the tax system.

Given the recent expansions of the federal Child Tax Credit and other state tax credits, our research underscores the importance of understanding who benefits and who is missed by tax-based policies, and points to ways in which policies can be adapted to responsively address gaps in accessing benefits.

Lisa. A. Gennetian is the Pritzker Associate Professor of Early Learning Policy Studies at Duke Sanford Center for Child and Family Policy. Support for this research was provided by the Robert Wood Johnson Foundation. The views expressed here do not necessarily reflect the views of the Foundation.

Methodology Notes

We analyzed data of nationally representative, cross-sectional, and biweekly samples from the United States Census Bureau Household Pulse Survey, collected during June 11–July 21, 2020 (weeks 7–12, or referred to as “the early period”) and January 16–March 29, 2021 (weeks 22–27 or “the late period”). We focused on these two time periods because data on receipt of stimulus payments were collected only in these weeks. To select our two samples—that is, all households and Hispanic households—we began with 348,057 households, including 45,429 Hispanic households, and excluded about 6 percent of all households and 3 percent of Hispanic households with incomes higher than the EIP eligibility thresholds ($200,000 and above for married couples and $150,000 and above for single individuals with children). This resulted in an analytic sample of 309,548 households, including 43,063 Hispanic households. We applied the Census Bureau’s household weights to all of our estimates and statistical tests.

Our dependent variable was household-level receipt, or any household member’s receipt, of any stimulus payment from the federal government. More precisely, in the early period, we treated as households with non-receipt any households selecting “not applicable, I did not and do not expect to review the stimulus payment” as their answer to the question asking whether anyone had already received or expected to receive the payment (without the receipt timeframe specified); we considered all other households to be households with receipt. In the late period, we based our variable on reports of actual receipt in the last seven days. This measurement change may partially explain the difference in the total receipt rate between the early and late period; therefore, throughout our analysis, we focused on comparisons within each period and included interaction terms of the late period with all correlates considered.

We conducted descriptive, time trend, and multivariate analyses of the rate of EIP receipt (see Appendix A, Figure 1, and Appendix B, respectively) and its key correlates, including race/ethnicity, age, gender, marital status, educational attainment, current self-employment status of the respondent, the number of children in the household, whether anyone in the household had experienced a loss of employment income (since March 2020 in the early period and in the last four weeks in the late period), and the level of past pre-tax household income (from 2019 in both periods). For the time trend analysis, we showed rates of receipt by race/ethnicity of households; for the descriptive and multivariate analyses, we presented results separately for the full and Hispanic samples. In our multivariate analysis, we estimated linear probability models predicting the likelihood of EIP receipt using all correlates from our descriptive analysis.

Appendix A: Characteristics of Lower-Income Households with Children, Total and by Hispanic Ethnicity

Because our analysis showed that Latino households had a lower receipt rate in the early period than non-Latino households, we summarize how their characteristics differed from others to explore the likely factors associated with receipt. Latino households had lower socioeconomic status than non-Latino households, which comprised the majority of all households. Over half of all households that received any stimulus payment reported residing with a household member who experienced a loss of employment income, compared to over 60 percent of Latino households who reported the same. Latino households that received any stimulus payment were more likely to be headed by someone with lower educational attainment and had lower household incomes in the past year (2019).

Appendix B. Linear Probability Models for Receipt of Economic Impact (Stimulus) Payments

© Copyright 2025 ChildTrendsPrivacy Statement

Newsletter SignupLinkedInYouTubeBlueskyInstagram