Current federal moratoria on evictions and foreclosures for people unable to pay their rent or mortgage during the COVID-19 pandemic are scheduled to end by June 30, 2021, and the eviction moratorium is in immediate legal jeopardy. Unfortunately, the consequences of ending eviction and foreclosure protections for non-payment would fall disproportionately on households with children, who are more likely than households without children to have difficulty paying rent or mortgage, according to data from the U.S. Census Household Pulse Survey. This brief uses Pulse data from households with and without children to analyze the prevalence of households with difficulty paying for housing, and suggests that—to prevent these families from experiencing housing instability or homelessness—state and federal policymakers should provide eviction and foreclosure supports to families and landlords through rental and mortgage assistance, and should offer additional supports to families who have struggled during the pandemic.

I. Context

The CARES Act, introduced in March 2020, included a 120-day moratorium on residential evictions, and on foreclosures on properties with federally backed mortgage loans. In September 2020, the Centers for Disease Control and Prevention (CDC) enacted a second set of moratoria that sought to contain the spread of COVID-19 by temporarily halting evictions and foreclosures from residential properties. The CDC reasoned that these moratoria—extended in February 2021 to June 30—would allow more people to self-isolate when infected with COVID-19 and enable authorities to more easily introduce and encourage stay-at-home and social distancing measures. However, these moratoria were interpreted and enforced differently across the country and were not able to protect everyone. Eviction filings have continued throughout the pandemic.

According to the Eviction Lab, these moratoria have resulted in an estimated 1.55 million fewer eviction filings than would have been expected in a “typical” year. If the moratoria are overturned or allowed to lapse, and if more states roll back their enforcement, millions of Americans who are behind on their rent or mortgage—or who may not be able to make their next payment—are at risk of losing their housing.

II. Households with children are at higher risk of losing their home than households without children

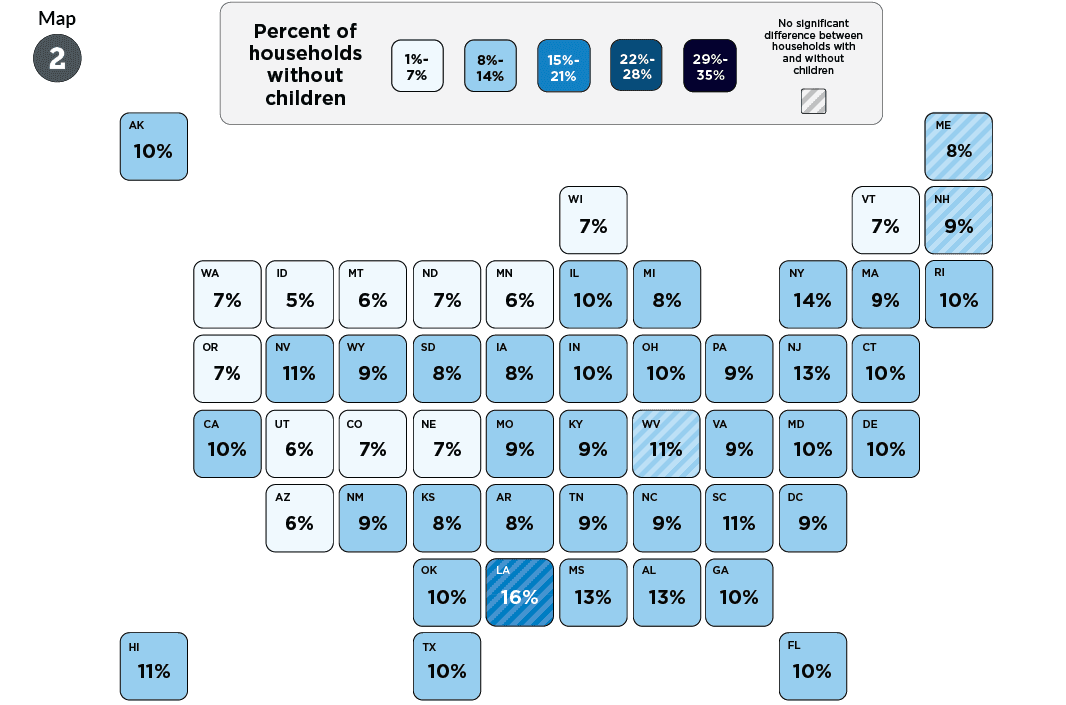

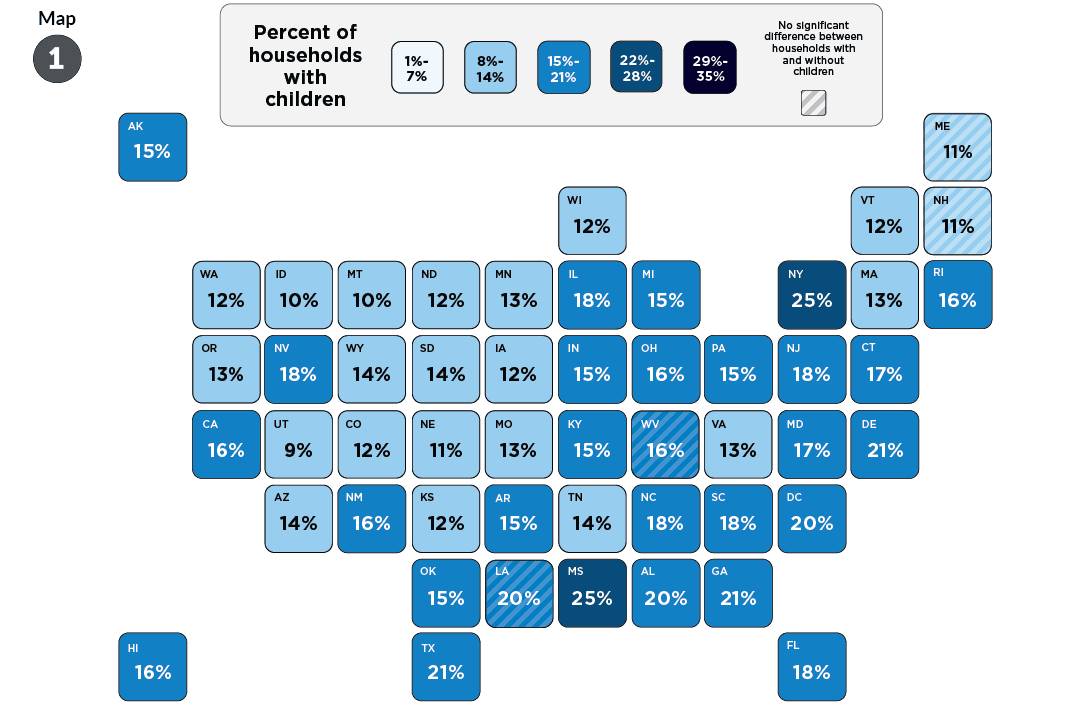

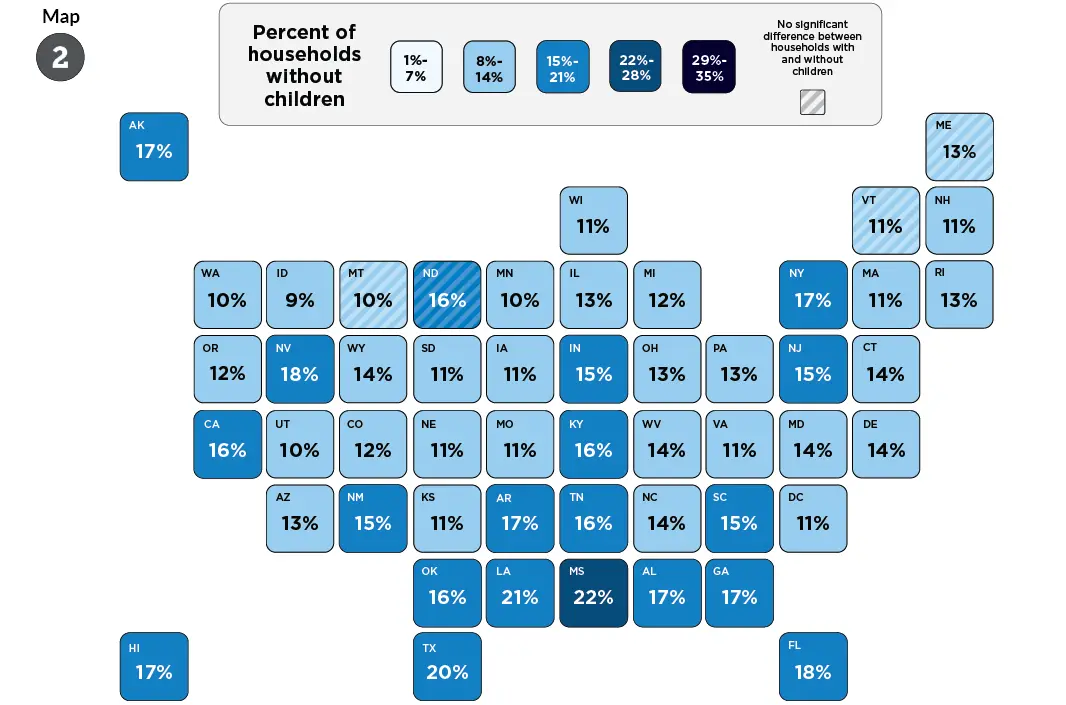

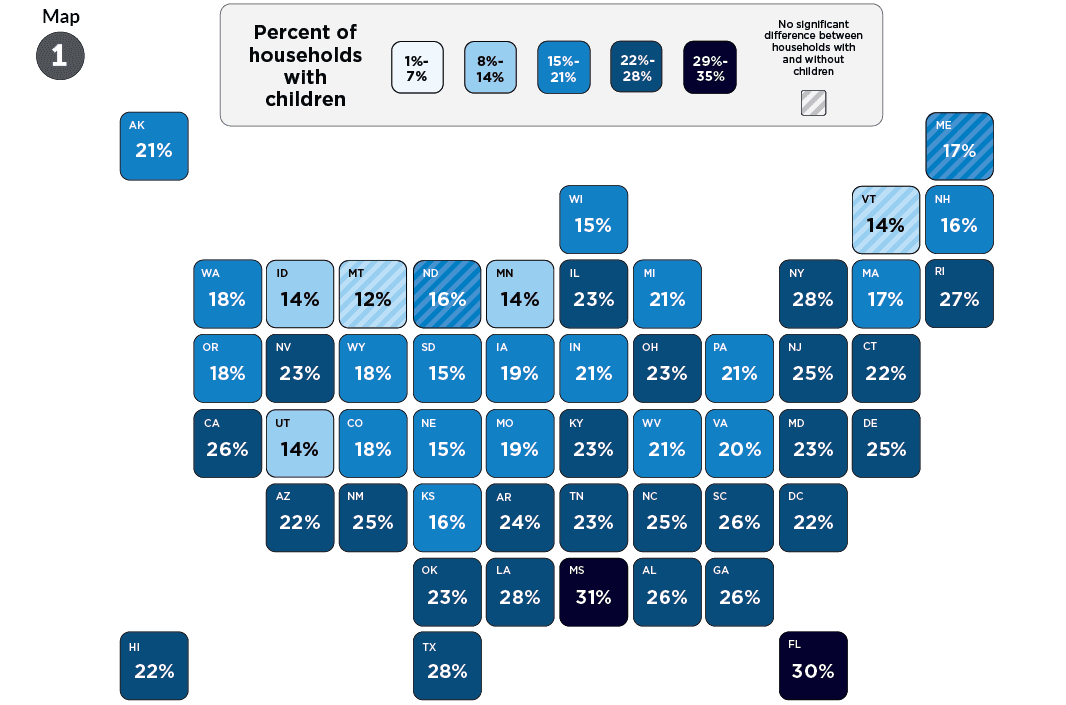

According to analysis of the Census Bureau’s Household PULSE Survey data collected from January 6 through March 29, 2021, among households with rent or mortgage payments, those with children were significantly more likely than those without children to be behind on their rent or mortgage payments, and to have little or no confidence in their ability to make their next payment in 46 states and in Washington, DC. The share of households with children who were not “caught up” on their housing payments were among the highest in Mississippi and New York, where 25 percent (1 in 4) reported being behind on payments. Additionally, Mississippi and Florida had the highest share of households reporting little or no confidence in their ability to make their next payment (31% and 30%, respectively).

Households with children are more likely than those without to report being behind on their rent or mortgage payments

Click the arrows on either side to view the maps for households with children (1) or without children (2)

Households with children are more likely than those without who reported little or no confidence in their ability to make their next housing payment

Click the arrows on either side to view the maps for households with children (1) or without children (2)

Source: Child Trends analysis of Census Bureau’s Household Pulse Survey data, January 6-March 29, 2021

Note: Confidence intervals for state estimates available upon request. Please contact Sara Shaw here.

The high rates of families struggling to pay for housing are especially concerning as we approach the end of the current federal eviction and single-family foreclosure moratoria, on June 30, 2021. Some states are moving to end, or have already ended, state-sanctioned pandemic eviction moratoria or the enforcement of federal eviction moratoria. For instance, Texas (where 20% of households with children are behind on their housing payment, and 28% report little or no confidence in making their next payment) ended enforcement of federal eviction protections as of March 31, 2021.

Meanwhile, 11 other states never enacted state measures or moratoria to stop evictions, and states such as Virginia (where 13% of families with children are behind on their housing payment, and 20% report little or no confidence in making their next payment) have repeatedly let their moratoria expire before renewing them again.

These approaches (or lack thereof) are likely to result in high rates of evictions after the federal moratoria are lifted. Furthermore, because federal moratoria do not forgive payments for either rent or mortgages, families who are behind on their rent or mortgage are likely to come out of the pandemic with a great deal of debt to landlords or mortgage companies.

III. To prevent families from experiencing housing instability and homelessness, we need to stop evictions and provide family supports

These data highlight concerning trends and inequities in access to stable, affordable housing for families. Housing instability can have lasting detrimental effects on children’s health, educational outcomes, and overall well-being. The move to restart evictions and foreclosures is anticipated to be most harmful for Black and Hispanic families and households. Black single mothers were at the greatest risk for eviction prior to the pandemic, and are likely to remain at greater risk during and after the pandemic. This is due, in large part, to a history of housing policies and programs in the United States that discriminate based on race and familial status.

The American Rescue Plan provides resources to address issues related to families’ housing needs, including emergency rental and mortgage assistance. While states vary greatly in their housing policies, programs, and supports, it will be critical for states to explicitly address families’ housing needs by capitalizing on these new resources. For example, states can educate landlords and tenants about state and federal anti-discrimination laws and increase their access to affordable, family-friendly housing. The American Rescue Plan also provides useful resources to reduce the impact of housing instability on children’s health and well-being. For example, the Plan includes investments in many family supports such as early education and child care (e.g., Head Start and child care subsidies) and education, access to nutrition services, and the Child Tax Credit. These supports may mitigate some of the risk to children’s health and well-being associated with housing instability and homelessness.

© Copyright 2025 ChildTrendsPrivacy Statement

Newsletter SignupLinkedInYouTubeBlueskyInstagram