In 2019, the federal government disbursed $61 billion through the Earned Income Tax Credit (EITC), considered one of the most effective programs for reducing child poverty and promoting economic mobility among low-income families. Yet each year, one out of every five eligible workers misses out on this valuable tax benefit. Outreach is critical to ensure that working families get the support they deserve.

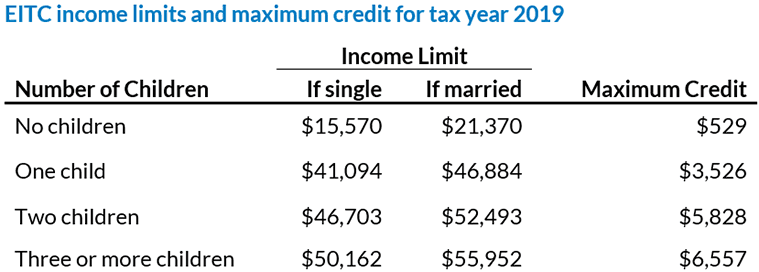

The EITC is a federal tax credit designed to help working families support themselves and their children while also encouraging workforce participation. The income limit and maximum credit varies by marital status and the number of children in the family (see table below).

Source: Internal Revenue Service

However, the EITC only works if potential beneficiaries file taxes and claim the credit on their tax return. According to IRS estimates of participation rates in tax year 2018, more than six million households eligible for the EITC (one in five) did not receive it. Additionally, there are known racial/ethnic disparities in EITC receipt: Hispanic families, for example, are among the least likely to know about or have ever received the EITC.

Research offers three reasons why state and local officials, as well as nonprofit and community partners, should work to increase program participation:

The EITC promotes workforce participation and supports local economies. The EITC encourages work because tax filers receive the credit starting with their first dollar of earned income. The credit amount increases as household income rises until it reaches a “phase-out” level—often $20,000 to $25,000, depending on marital status and number of dependent children—after which the amount of credit begins to gradually decline. Several studies have found that the EITC does boost employment, particularly among single mothers. Others indicate that local economies also benefit from increased payroll tax revenues and spending.

The EITC lifts millions of families with children out of poverty each year. The EITC does not just offset taxes owed; it is also refundable. In other words, if the credit is more than what a household owes in taxes, the tax filer will receive the difference back from the government. For example, a single mother with two dependent children who earns $17,000 a year and does not have any tax liability would still receive a refund of $5,828, effectively supplementing her income by $486 per month and pushing her above the 2020 federal poverty level of $21,720 for a family of three. Indeed, in 2018, the supplemental income provided by the EITC lifted about 5.6 million people out of poverty, including about 3 million children, and reduced the severity of poverty for another 16.5 million people, 6 million of whom were children. Moreover, because the EITC is administered through the IRS as a tax credit, rather than through a separate public assistance program, it has the potential to reach more people and minimize administrative burden with less risk of stigmatizing families.

The EITC improves children’s health, academic achievement, and economic mobility. Research suggests that the increased purchasing power afforded by the EITC to low-income working families has significant benefits for the children living in these households. For example, increased EITC payments have been associated with reduced psychological stress, improved physical health, and increased use of prenatal care among low-income expectant mothers. These benefits were, in turn, passed along to babies, who were less likely to have low birth weights—a risk factor for health problems later in life. Children in households that experienced increases in income from the EITC have seen improved math and reading achievement scores. These income boosts are also linked with increases in high school graduation and college attendance rates, as well as later earnings, thereby supporting economic mobility. Taken together, research on the impacts of EITC-based increases in household income suggests that it provides a wide range of short- and long-term benefits for children.

More research is needed to better understand the factors—and state and local policies—that may influence EITC uptake, and the EITC should not be considered a panacea for child poverty. Families in deep poverty have very low levels of earned income and are not eligible for the maximum credit. Further, the EITC is typically disbursed in a single “lump sum” payment at the end of the tax year, limiting its utility to support families’ immediate needs, such as monthly bills. However, millions of moderate- and low-income households claim this credit and benefit from the supplemental income it provides, and millions more stand to benefit as well. In light of the wealth of research highlighting the myriad ways in which the EITC promotes the well-being of children and families across the nation, it is vitally important to get the word out about this crucial program.

State and local governments, nonprofits, and community partners can work together to share resources that increase awareness of the EITC and connect workers with tools like the IRS EITC Assistant and free tax preparation sites. Families should also check whether they are eligible for other tax credits, such as the Child Tax Credit, education credits, or state-level EITCs.

© Copyright 2025 ChildTrendsPrivacy Statement

Newsletter SignupLinkedInYouTubeBlueskyInstagram