Lessons From a Historic Decline in Child Poverty

How Poverty Is Measured in the United States

Authors: Dana Thomson, Renee Ryberg, and Katherine Paschall

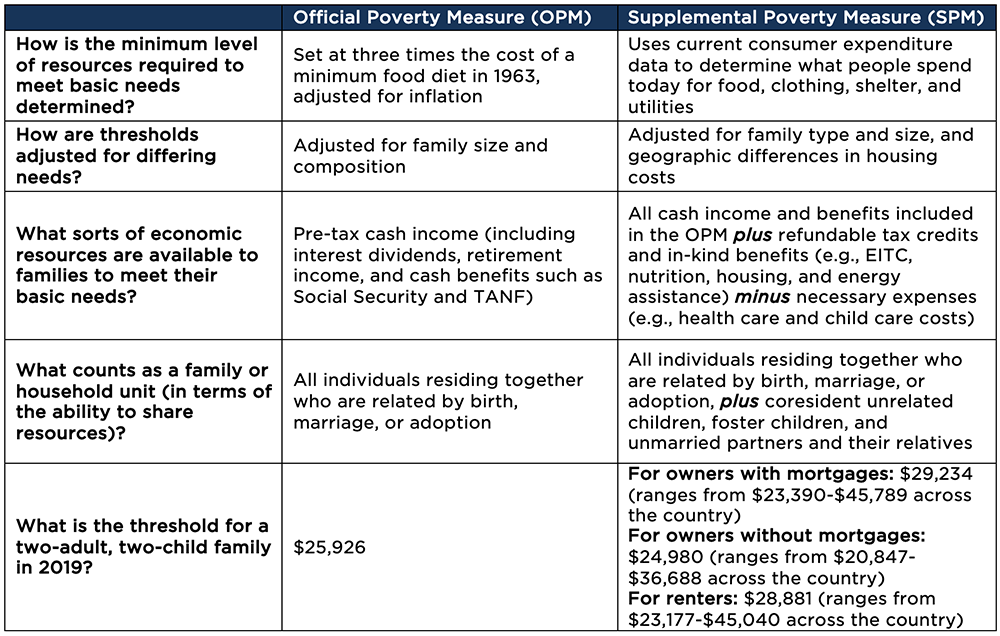

Children in the United States are defined as living in poverty when their family’s economic resources are below a given threshold of what is minimally required[1] for meeting their basic needs, such as food, clothing, shelter, and utilities. Two of the most accepted measures for determining poverty thresholds for the United States are the Official Poverty Measure (OPM) and the Supplemental Poverty Measure (SPM). The measures differ in their assumptions of what is minimally required for a family to meet its needs and what resources are available to a family to meet those needs (see table below).

Based on the assumption that families spend approximately one third of their income on food, the OPM uses a poverty threshold that is three times the cost of a minimum food diet in 1963 and is adjusted every year for inflation. As housing and other costs have risen and spending on food accounts for a much smaller proportion of family budgets, the SPM—first developed in 2009—uses more updated information about what people spend today for food, clothing, shelter, and utilities. While both measures adjust these costs to account for the needs of families of different types and sizes, only the SPM accounts for geographic differences in costs of living.

With respect to how each measure determines what resources are available to families to meet their needs, the OPM counts cash income (i.e., wages and salaries), interest, dividends, retirement income, and some cash benefits (e.g., Social Security and Temporary Assistance for Needy Families, or TANF). The SPM similarly counts cash income but also includes benefits from federal programs that are not considered cash—such as refundable tax credits and nutrition, housing, and energy assistance. In addition, the SPM subtracts necessary expenses, such as health care costs, child care costs, costs of commuting to work, and taxes.

Each measure serves a different policy goal. Broadly, the SPM—with its more up-to-date assumptions about current living needs and expenses and inclusion of government benefits—is a better indicator of the overall economic well-being of U.S. children. However, the income-based OPM remains important for understanding what children’s economic well-being would look like without government programs like refundable tax credits and the nutrition, housing, and energy assistance mentioned above.

The Official Poverty Measure (OPM) and Supplemental Poverty Measure (SPM) Use Different Assumptions About Family Needs and Resources

Sources: U.S. Census Bureau. (2021). Measuring America: How the U.S. Census Bureau Measures Poverty. Fox, L. (2020). The Supplemental Poverty Measure: 2019.

The OPM vs. SPM over time

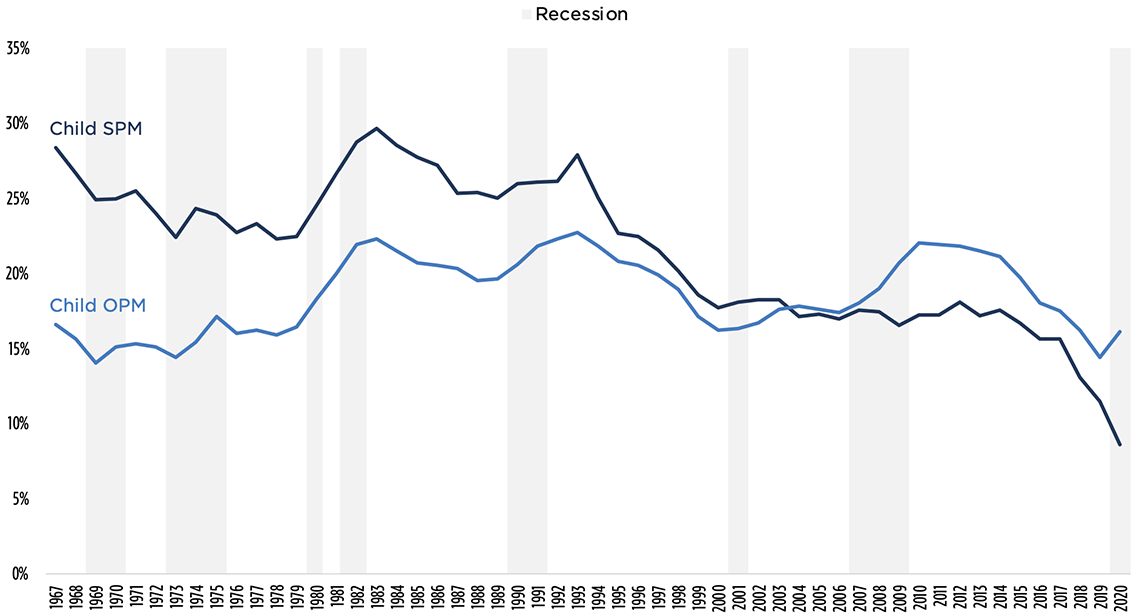

From 1967 to 1993, more than one in four children (26%), on average, lived in families with incomes below the SPM[2] poverty threshold. The OPM estimates of child poverty were considerably lower than SPM estimates (see figure below). In 1967, the OPM child poverty rate was 17 percent, while the SPM child poverty rate was 28 percent, amounting to a 12 percentage point difference between the two thresholds. This gap is likely due to the fact that the SPM subtracts necessary expenses—such as out-of-pocket medical expenses and work and child care expenses—from its calculation of a family’s available resources. The gap between OPM and SPM child poverty rates narrowed slowly from 1967 to 1993—likely due to the anti-poverty policies enacted in the decade following President Johnson’s 1964 declaration of war on poverty. While the gap in the percentage of children calculated as being in poverty between the two thresholds was substantial during this period, both the OPM and SPM moved in relative synchronicity with economic cycles.

Beginning in the early 1990s, however, the SPM child poverty rate began to follow a quite different pattern from that of the OPM. The OPM child poverty rate continued to rise and fall with economic cycles, but overall remained stubbornly steady: In 2020, the child poverty rate, as measured by the OPM, was 16 percent—less than 1 percentage point lower than when it was first measured in 1967. Meanwhile, the SPM child poverty rate, which had followed a similar cyclical pattern up until 1993, decoupled from the economic cycles and the OPM. Child poverty, as measured by the SPM, began to decline dramatically and, while it leveled off during economic downturns, it otherwise continued along a mostly downward trajectory through 2020. By 2020, the SPM child poverty rate was 9 percent, down from 28 percent in 1993, representing a 69 percent decline, or a decrease of 19 percentage points.

Child Poverty Rates Using the Official Poverty Measure (OPM) and Supplemental Poverty Measure (SPM), 1967-2020

Sources: Child OPM poverty rates are based on The United States Census Bureau’s Historical Poverty Table 3. Child SPM poverty rates are based on historical SPM data from the Columbia Center on Poverty and Social Policy, anchored to 2012 thresholds. Recession data are from the National Bureau of Economic Research.

A note on methods

In the figure above, we present rates of child poverty in the United States from 1967 to 2020, using both the official (light blue line) and the supplemental (dark blue line) measures of poverty. While the Supplemental Poverty Measure (SPM) was not developed until 2009, researchers at Columbia University’s Center on Poverty & Social Policy have estimated annual SPM thresholds and poverty rates going back in time to 1967, using data from the Current Population Survey’s Annual Social and Economic Supplement (CPS ASEC). Because SPM thresholds are adjusted for differences in living standards that can change over time, it is difficult to make comparisons from one year to the next. However, to facilitate over-time comparisons, the researchers at the Center on Poverty & Social Policy have also constructed SPM thresholds and poverty rates that are anchored to 2012 living standards and adjusted backward in time for inflation. We use this anchored historical measure of SPM-based poverty to present trends in child SPM poverty over the past half century.

Endnotes

[1] We think—as do many poverty experts—that the current poverty thresholds are too low to adequately capture families’ economic needs. Income at our current poverty thresholds is not enough to cover essential living expenses—such as rent, food, and clothing for a typical family with two adults and two children—and is insufficient to support savings and investment in a family’s future economic security. While we use the Census Bureau’s definition of poverty in this report, we also recognize that simply moving families across the poverty threshold does not guarantee that they have adequate resources to meet their basic needs.

[2] While developed in 2009, historical SPM rates have been calculated by researchers at Columbia University’s Center on Poverty & Social Policy for the period between 1967 and 2008.

© Copyright 2025 ChildTrendsPrivacy Statement

Newsletter SignupLinkedInYouTubeBlueskyInstagram